Lei Feng: press author: Liu Bin, Internet company strategic investment. This article is a combination of the author's three thematic articles.

Jeff Bezos founded Amazon in 1995. Twenty years later, Amazon’s market value has reached US$340 billion, making it the world’s largest online retailer and the world’s second-largest Internet company, second only to Alphabet (Google).

The great success of Amazon also brought bezos amazing wealth. Bezos is still the largest shareholder of Amazon. In 2016, Forbes Global Wealth ranked 5th and personal net worth reached 45.2 billion U.S. dollars.

Bezos is recognized as the most visionary CEO. The Harvard Business Review commented him so:

He's invented a new philosophy for running a business.

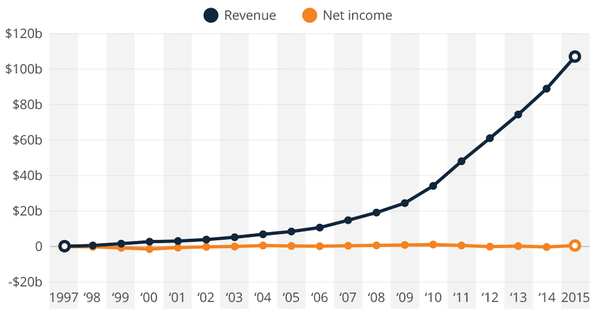

Has always been interested in Bezos's "new philosophy". To give a most direct example, as shown in the figure below, Amazon’s operating income has grown nearly exponentially since its listing in 1997, but in most cases, it’s losing money. What does Bezos think? How is it persuading Wall Street and investors?

Source: Amazon Financial Statements

Fortunately, we can find enough information to understand his "new philosophy". There are several books describing Amazon and Bezos, most of which were written before 2010. The most comprehensive and up-to-date book is the "The everything store: Jeff Bezos and the Age of Amazon" published by Brad Stone in 2013. (Anywhere: Bezos and the Amazon era). At the same time, like Warren Buffett, Bezos will also write a letter to shareholders each year to explain the achievements of the past year and Amazon's main business philosophy and decision logic. There are 19 such letters. In addition, we can also find many of his public speeches and interviews.

In the past two weeks, in the process of reading these books and materials, I was always impressed by Bezos's insights. At the same time, I feel that there is no article in the country that describes these wisdoms systematically, so I’m going to try to organize the next few articles. a bit. Today we start with the strategy.

Dominant Strategy vs. Differentiation StrategyA classic quote about strategy:

Strategy is all about trade-offs.

As a company, is the strategic direction of high quality or low price? Are different products occupying different market segments, or are they focusing on one market and expanding a single product to achieve economies of scale? Strategy is a compromise and finds the best direction for you.

This is not the case with Amazon's strategy. It does not choose between high quality and low prices. Just like the Dominant Strategy in game theory, no matter how the competitor chooses, Amazon uses its best strategy and never considers the trade-off: it also provides unlimited choices, top-tier shopper experience and the lowest price. For 20 years, this strategy has never changed.

For example, Amazon launched Prime in 2005, allowing users to pay $79 to enjoy free two-day delivery service (users waited at the time after the order was generally more than 5 days). This service has been controversial internally.

If the cost of a single order for a courier company is $8, and Prime has 20 orders a year, then the company's annual transportation costs will reach $160, which is much higher than the $79 membership fee. This service is too costly for the company and there is no way to break even.

- "Anywhere: Bezos and Amazonian Times"

In the end, Bezos insisted. The facts also prove that Prime has achieved great success in the next few years. Members who joined Prime have doubled their spending on Amazon, and a large number of customers have become fans of Amazon because of this service. Prime became one of Amazon's key decisions to successfully shake off Ebay.

Build your strategy on the same thingsAfter understanding Amazon’s dominant strategy, one natural question is: Why is low price, unlimited choice, and shopper experience the core of the dominant strategy?

At the 2012 re:Invent conference, Bezos gave a clear explanation:

I was often asked a question: "What will change in the next 10 years?" But I rarely ask "What is the same in the next 10 years?" I think the second issue is more important than the first issue because you need to base your strategy on the same things.

In Amazon's retail business, we know that consumers will want lower-priced products, and still do so 10 years later. They want faster logistics and more choices. It's hard to imagine that a customer would come and say to me after 10 years: "Jeff, I like Amazon, but your price can't be more expensive, or the arrival time is slower."

So we put our energy into these constant things. We know that the energy invested in it now will continue to benefit us in 10 years and 10 years. When you find a right thing, even after 10 years, it is worthwhile for you to devote a lot of energy to it.

The strategy is built on the same things. Bezos not only applies this philosophy to the retail business, but also applies to Amazon's AWS (Amazon Web Services).

With regard to cloud computing, the direction is also very direct. For me, it's hard for me to imagine that 10 years later, someone would tell me "I like AWS, but I hope it is not so trustworthy," or "I like AWS, but I hope it's a little higher price" or "I Like AWS, but I hope you can modify and improve the API slowly..."

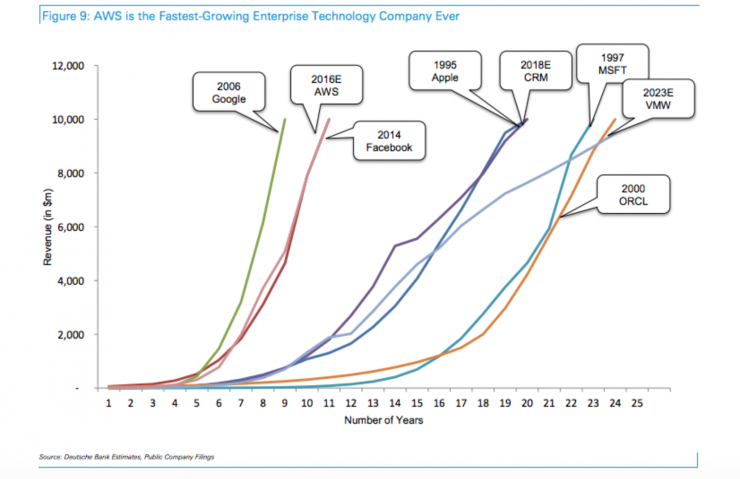

It is based on this dominant strategy that Amazon continues to invest in several key areas of energy and resources to establish a number of advantages in the field of cloud computing. This strategy has enabled AWS to gain ground in the area of ​​cloud computing. The combined market share of Microsoft Azure, Google GCE, IBM Softlayer, and Ali Cloud is also less than an AWS. Deutsche Bank is also expecting Amazon AWS revenue to reach US$10 billion in 2016.

However, for many people, offering low prices and providing a top-tier shopper experience is still contradictory. Other retailers can not do, why can Amazon?

The secret is hidden in Amazon's financial statements. Bezos gave his answer in a letter to shareholders in 2002. In fact, it is very simple, Amazon will convert most of the costs associated with the shopping experience into fixed costs, such as unlimited choice of goods, personalized recommendations and so on. When the vast majority of shopper experience is a fixed cost, with the rapid growth of sales, the cost ratio of unit sales drops rapidly. In addition, even if it is a part of changes, such as the cost of defective products in order fulfillment, when the company is committed to reducing the defective rate, the company's costs will decline, and the shopper experience will still rise.

Compared with the real economy, the Internet has made 100 million touches possible, and when a company can make good use of its huge scale and convert variable costs into fixed costs, it will create a huge cost advantage.

It is worth mentioning that, unlike differentiation strategy, this strategy of superimposing advantages in different fields often produces 1+1 far more than 2. The advantages of investing resources in different fields are not isolated. They are like turning a flywheel. When you start the flywheel, after using a small amount of power, you can make them interact with each other. The flywheel turns faster and faster. As early as 2000, Bezos and his executives discovered this:

Bezos and his assistant team described the prospect of the company entering a virtuous cycle, and they believe that this will be a powerful driving force for the company's development. The company's blueprint for the future is this: Attracting more customers at lower prices. More customers mean higher sales, and will also attract more third-party sellers paid to Amazon commissions to the site. This will also enable Amazon to make more profits from fixed costs, such as logistics centers and servers running websites. Higher efficiency will further reduce prices. They reasoned that as long as any flywheel runs smoothly, it will accelerate the entire cycle.

Amazon executives are excited about this. According to several members of the Amazon executive team at the time, they felt that after years of tempering, the company finally realized the rules of operation.

- "Anywhere: Bezos and Amazonian Times"

This is a vivid example of the Lollapalooza effect that Charlie Munger has been emphasizing. It is because of this fast-turning flywheel that Amazon's operating income draws a beautiful near-exponential growth curve.

We reflect on China's e-commerce. All along, many people think that e-commerce is a typical traffic economy. Traffic can be purchased, and the conversion cost between e-commerce is low. How can an e-commerce company establish its own core competitive advantage? Do e-commerce companies have to invest a lot of advertising or layout around traffic?

I think Amazon has given a good answer.

Finding the next great businessWhat is a great business? Bezos gave one of his answers.

An ideal business has at least four characteristics. Consumers love it, it can grow large enough, the return on capital is high, and it can stand the test of time - with the potential to last for more than a decade. When you find such a business, you don't just have to hold it, but you must tie it tightly with you just like your life partner.

—— Letter from Bezos to shareholders, 2014

In a letter to shareholders that year, Bezos announced that he thinks Amazon has discovered three such "life partners": Marketplace, Prime, and AWS. These three businesses are very daring bets. Since the beginning of the controversy, many people believe that these three businesses are difficult to succeed. But today, everyone must recognize the enormous potential of these businesses.

Mentioned in the previous article, Prime and AWS, where the Marketplace refers to the third-party platform sales business, it makes Amazon closer to the "Everything Store", greatly enriching Amazon's product range, which currently accounts for half of Amazon's sales, and Amazon. One of the main sources of profit.

As early as 1998, Amazon launched Auction.com in order to compete with eBay. Bezos was then reconciled and launched zShop, which allows customers to sell products at a fixed price. It was still unsuccessful. After several years of exploration and experimentation, Amazon launched a third-party sales platform and consignment model. This is actually a billion-dollar experience.

Recalling the history of the development of China’s B2C platform, we discovered that e-commerce companies such as Dangdang, JD.com, and No. 1 Stores have come up with a third-party sales platform. It has to be said that this has benefited from Amazon’s exploration. In the same way, when I first saw the Tmall supermarket consignment model, I was also very surprised and later learned that this was a model that Amazon had explored in the last century. It must be said that China's e-commerce company stands on the shoulders of giants.

So why can Amazon continue to find the next great business? Bezos' answer is to return to the company's most fundamental idea. What kind of cause, what kind of fruit.

Become the most customer-centric company in the worldAlmost all companies say they are customer-centric, but there is no doubt that Amazon is recognized as the best company and is known for it.

On many occasions, Bezos compares Amazon to Sony when explaining this fundamental idea to the public.

After World War II, Akio Morita founded Sony Corporation. Akio Morita said that Sony's mission is to make Japan famous for its high quality. At that time, Japan was generally considered to be producing low-quality and inferior products in other countries. Akio Morita did not say that Sony's goal was to make Sony famous for high quality, but chose a mission that was far greater than Sony itself.

Bezos has similar ideas. Bezos wanted all other companies to use Amazon as their highest customer-centric standard. This is completely different from the concept of competition as the center. It is precisely because of this concept that Amazon began to innovate in different directions that can improve the customer experience. It is precisely because of this philosophy that, unlike almost all other companies, Amazon has taken a longer-term approach to thinking about all business issues, because if a company has short-term benefits first, it is often difficult to insist on doing the right thing for customers. .

Based on the concept of customer first, Bezos believes there are two types of innovation in the company, one is customer backwards and the other is the ability forwards. The former takes customer experience as a starting point, while the latter starts from the company's current capabilities and ultimately comes down to better satisfying customers' needs. Marketplace, Prime, and Kindle are the first innovations, while AWS is the second.

Innovations come in different forms and scales. The most revolutionary innovations are those that provide others with the infrastructure to allow others to maximize their potential and pursue their dreams. Self service platforms are one of the best forms of innovation, such as AWS, KDP (Kindle Direct Publishing) or consignment model. They allow hundreds of thousands of people to experiment bravely and to complete original or impossible practices. These innovations are never zero-sum games. They continue to create win-win situations and create great value for developers, entrepreneurs, buyers, writers, and readers.

—— Letter from Bezos to shareholders, 2011

See the risks, be willing to bet and integrate them deep into the company's bloodstreamA common problem of large companies is the "one-size-fits-all" decision-making method, which greatly affects the company's efficiency and innovation. Bezos believes that Amazon is the best place for this world to fail, because the company is willing to take big risks even if it knows that 90% of the attempts will fail.

The creation of innovation largely depends on how leaders see risks and make decisions. For a company, there are generally two types of decisions:

One is irreversible decision making, and we must be very careful and cautious when we make such decisions.

And another decision is like we walk into a door. If we find it wrong, we can return it at any time.

Bezos believes that the problem for most companies is that they confuse these two risks. When a company becomes bigger and bigger, they tend to use the first type of risk response method in large numbers. This undoubtedly hinders the second type of experiment, which will eventually lead to the slow operation of the company, irrational risk aversion and reduction of new ones. Try to create a lack of innovation.

In addition, it is more important to try to integrate this courage into the corporate culture.

My main job now is to help maintain Amazon's culture. High standards, outstanding performance, innovation, dare to make mistakes, and dare to do bold experiments. These qualities that make Amazon unique have now been deeply integrated into this company, and even I cannot change it. If I decide tomorrow that Amazon will no longer have the courage to explore, I can't do it. This kind of culture is constantly self-reinforcing. Of course this is a good thing.

—— Bezos, Interview with Business Insider, December 2014

Amazon is a technology company, not a retail companyBezos firmly believes that Amazon needs to define itself as a technology company, not a retailer.

—— The Everything Store

Why can Amazon continue to discover great business? Looking through all the Amazon books, Bezos's speeches and interviews, and other public materials, they did not find any shortcuts. Over and over again, they got me back to the idea of ​​the company.

"Amazon is a technology company, not a retail company," is the idea that I read "The Everything Store" the biggest gain. I firmly believe that this is one of the fundamental reasons why Amazon can continuously discover great business.

This idea was proposed by Bezos in the early days of the company's founding, and it has been persisting so far. It is reflected in all aspects of Amazon. For example, Amazon has always recruited talents with high standards. Since its founding, it liked to recruit California Tech’s technical genius. After that, it has learned from the Stanford Machine Learning Professor and has been involved in the authority of algorithmic theory. Reading the history of Amazon, you will find that in many key innovations, this group of technology fanatics has appeared.

Technology is integrated into all our teams, all our processes, our decisions, and our approach to business innovation. It is deeply integrated into everything we do.

Innovation is our DNA, and technology is our most basic tool for evolving and enhancing our customer experience.

—— Letter from Bezos to shareholders, 2011

The more you read a company biography, the more you discover that great companies are similar. Looking back at these three points, I can't help but say: "Nothing big deal."

What is difficult?

It was as early as 1995 that they wanted to make clear this and branded the founders' ideas step by step into the company's culture and become a force for spontaneous innovation. It is these ideas that, after 20 years of ups and downs, are still so full of insights and wisdom that they are timeless.

The following is a wonderful comment by Buffett on Bezos.

You can't do better than Bezos. There are always people in this world. You don't want to compete with him in his field. When you look at these people, Bezos is obviously the first one.

Jeff demonstrated the amazing talent and ability to please customers. Interestingly, like Fred Smith (founder of FedEx Express, CEO), it does not mean that he has made any breakthroughs in technology or technological innovation. When he started, he did something quite common: selling books. All the elements of Amazon's business are known to the public, but he integrated everything in a creative way and made a new industry.

We have all bought books before. We are now buying the same products on Amazon. He has made us even happier. If you think about it this way, you will find out how incredible it is.

- Warren Buffet, Interview with CNBC, May 2016, USA

The ultimate goal of a company is not profitWe can clearly see that in the past 20 years, Amazon's operating income has achieved near-exponential growth, but the profit has been close to zero.

So, I mentioned this question before:

Why Amazon has not been making money? A company that lost money for most of the years, why can it become the second largest Internet company in the world?

On the surface, the answer to these questions is simple: Because a company's value is a discount to its future free cash flow, not a profit.

Just as Bezos wrote to the shareholders in 2004:

Measure Amazon's final financial indicators, which we have most wanted to promote for a long time, is free cash flow per share.

But this is in fact contrary to our business sense. Most companies are emphasizing profits. Almost all people start with business and know that the company's goal is to make a profit. Where is the problem?

Bezos used an example to illustrate this issue.

Assume that today you invented a vehicle that can quickly transport passengers. This transportation is very expensive and its manufacturing cost is 160 million. We assume that the vehicle can be used for 4 years and transport up to 100,000 passengers per year. Each time you take a fare of 1,000 yuan, you need 450 yuan in energy costs, and 50 yuan in labor and other costs.

We envisage that this business is growing rapidly. It will be able to reach 100,000 passengers in the first year and use all its transportation capabilities. Therefore, after deducting all costs and depreciation, the net profit of this business is 10 million, a net interest rate of 10%.

The company's primary goal is net profit, so based on the above data, the founders decided to invest more money to achieve a doubling increase in sales and net profit, so they increased in the next 2nd to 4th years. 1, 2 and 4 such vehicles.

The following is the summary of the income statement (K RMB) for the first 4 years:

The pleasing result is that the compound annual growth rate of net profit is 100%, and the accumulated net profit rate in four years reaches 150 million. If you only consider the above income statement, investors must be very happy.

However, when we look at the cash flow statement, we will find the problem. In the next 4 years, the cumulative free cash flow generated by this business is -5.3 billion. As shown in the table below.

This example tells us that if we only focus on profitability, there is no way to judge whether a company is creating value for shareholders.

From the perspective of cash flow, you can easily find that in the above example, the more you reduce the investment in new modes of transportation, the better the cash flow status. But even if we only invested in one vehicle in the first year, the accumulated cash flow did not exceed the original transportation investment of 160 million in the fourth year. When we discounted the four-year cash flow (assuming a 12% discount rate), the present value of these cash flows is still less than the original investment of 160 million.

Obviously, no matter what the growth rate, we should not do this business because this business is fundamentally problematic.

At the same time, in this example we can clearly see the opposition between profit and free cash flow, which happens in real time in the real business environment.

Consider such a problem. Today you have 10 million funds to invest in. The annual net profit of company A in the next 10 years is 3 million. At the beginning of each year, A must reinvest three million yuan of profit in the previous year into the operation of this year to ensure the normal business operation of the company. Company B's annual net profit for the next 10 years is zero, but it can generate 3 million free cash flows each year.

Which company will you invest in?

If it is me, I will invest in Company B. Use 10 million dollars in exchange for the right to use 30 million funds in the next 10 years.

In this case, we can not help but think: Is the company's ultimate goal really for profit?

We introduce a simple formula: Y=f(x), where Y represents the value of the company and x represents the input of the company's owner's factors of production. Different companies have different x and different Y. What is the nature of the company?

Is f, is the efficiency of capital. The most fundamental difference between different companies is the different efficiency of capital use.

The numerator of capital efficiency is free cash flow, and the denominator is capital invested. When the invested capital is constant, the only way to increase capital efficiency is to maximize free cash flow.

Therefore, in a sense, the ultimate goal of the company is not to make profits, but to make better use of capital to maximize free cash flow. Profit is just a form of free cash flow.

Amazon's surprising capital efficiencyBased on the above considerations, let's take a look at the Amazon company.

In 2004, for example, when Amazon’s sales were about US$7 billion, due to the very fast inventory turnover, the amount of funds used by inventory products was only US$480 million.

Another data will make you even more surprised: In 2014, Amazon's fixed asset investment was only 246 million US dollars, accounting for only 4% of the year's sales.

Use a crudeest method to infer. We assume that the Amazon supplier’s account period is 3 months, and Amazon’s profit margin is zero. The above data means that Amazon invested 4.8+2.46=726 million US dollars at the beginning of the year to ensure its normal operation, due to the account period. Amazon has more than 70/4=17.5 billion free cash flow.

With the 726 million yuan of funds at the beginning of the year, the free use of 1.7 billion dollars in exchange was only as high as 2.5 times. How amazing capital efficiency.

When we think about the truth behind these numbers, the question at the beginning naturally has answers.

Finally, if you rethink Amazon's strategy and innovation with a view to maximizing free cash flow and capital efficiency, I promise you will have a deeper understanding.

No wonder the Harvard Business Review commented on Bezos:

He's invented a new philosophy for running a business.

The deeper we think, the more we can see every aspect of the strategy, how each of the innovation decisions is made, and how we can use capital extremely efficiently to achieve maximum cash flow. These ideas are intertwined and are so natural.

As of this writing, only Bezos remains deeply admired and admired.

Letter from Bezos to shareholders, click here to download

This article was authorised by the author to be published by Lei Fengnet (search for “Lei Feng Net†public number) and may not be reproduced without permission!

Front Screen Glass Lens For Iphone

Glass Cover For Iphone,Front Screen Outer Glass Lens,Glass Cover With Oca,Glass Cover For Touch Screen

Shenzhen Xiangying touch photoelectric co., ltd. , https://www.starstp.com