Sanan Optoelectronics is undoubtedly the most profitable company in China's LED industry. Whether it is gross profit margin or net profit margin, it is not as high as a manufacturing company.

Generally, the gross profit margin of the manufacturing industry is higher than 30%, and the net profit margin can exceed 15%. This is a very good performance, and Sanan has maintained a gross profit of more than 40% in addition to the decline in the industry's low profit in 2012~2013. The net profit rate reached a level of more than 30%.

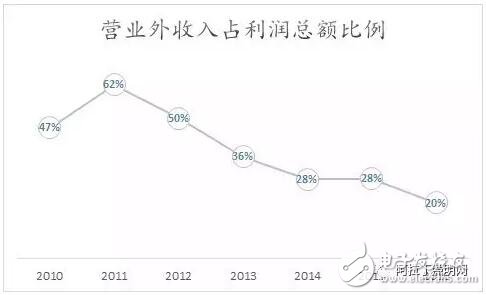

Sanan’s net profit is due to the fact that MOCVD equipment subsidies are well-known facts. However, if the bureau’s stereotype of relying on subsidies is different, it may be farther away from the facts. In recent years, with the development of Sanan, the proportion of non-operating income to profit has become lower and lower. From 62% in 2011 to 20% in 2016, Sanan's own profitability has been strengthened step by step. Understand the reasons behind Sanan's high gross profit margin and high net profit margin, it is possible to answer this question better: Why is Sanan Optoelectronics so profitable?

Analysis of the reasons for the high profit margin of Sanan and Sanan

First of all, I don’t agree with the external commentary that Sanan’s gross profit is from the financial controller’s financial technology. The clever woman is hard to be without the rice, and the high-tech financial technology can not create income, and there is almost no way to hide the direct cost. Moreover, Even if you can handle some accounting items more skillfully within a year or two, it is impossible to use techniques to modify the gross profit margin far higher than the peers within a few years.

Data source: Sanan company financial report LEDinside finishing

The source of high gross profit for Sanan can be explained in several ways:

1) Scale effect of manufacturing.

Although the LED chip manufacturing is not as high as the semiconductor manufacturing, it is also a heavy asset industry, and the scale effect of manufacturing is very significant. Everyone knows more about the high cost of MOCVD equipment. In fact, the high-purity gas supply system specially prepared for chip production, the ultra-clean plant and other infrastructures are more inseparable special assets, which will greatly increase the fixed production of LED chip manufacturers. cost. Instead, MOCVD, from the perspective of long term, is more like variable cost.

Sanan has the world's largest LED chip production capacity, accounting for about 20% of global chip production capacity. As long as the capacity utilization rate reaches a reasonable level, these fixed costs Sanan can be amortized on a larger chip production, then only the average cost is estimated. One can be 10% lower than the average competitor.

2) The scale effect of R&D.

As one of the sub-sectors of the semiconductor industry, LED is also a research and development-intensive industry. Because Chinese LED companies have entered this field relatively late, they are in a relatively inferior position in the original technology accumulation and patent enclosures. The impression is that Chinese LED companies have low technical content.

Sanan has only about 1,200 patents on the surface. In fact, in order to maintain the continuous improvement of product competitiveness, micro-innovation, process innovation must be continuous, but most will not be converted into patents, but The form of proprietary technology exists. To give a simple example, many product lines, Sanan is able to continue to maintain the same chip area is 5% higher than the competitor's brightness, which actually constitutes the technical guarantee of Sanan's product premium.

The scale effect of R&D is reflected in the scale of investment in R&D team and R&D funds of Sanan. There are about 470 doctors or Japanese and Korean Taiwanese technical experts in Sanan, and 502 people are senior engineers and masters. As far as the talent pool of the LED optoelectronic industry is concerned, Sanan has the largest talent pool in the world. The direct R&D capital investment and the indirect R&D personnel cost are conservatively estimated to be more than 300 million yuan, which is equivalent to the annual operating income of a medium-sized chip factory in previous years.

Such huge R&D expenditures are a huge burden for a company with insufficient production scale. For Sanan, the research and development cost of amortization to each chip is negligible, and the premium brought by product performance can be completely covered.

Pneumatic Paint Mixer,Clamped Pneumatic Mixer,Pneumatic Mixing Paint Mixer,Clamping Bucket Air Mixer

RUDONG HONGXIN MACHINERY CO.,LTD , https://www.rdhxmfr.com