The newly released iPhone 7 Plus at the beginning of the month finally introduced a dual-camera design, and in fact, in the fall of 2016, this year we saw a sudden rise in the dual-camera phone. This year, 360 took the lead in launching a dual-camera model, followed by Huawei P9, and now even the iPhone has followed suit.

By adding a camera, the designer can improve the camera performance while maintaining the slim and light shape of the phone. The design of dual cameras has become a major trend in the development of smart phones. This design enables many camera experiences such as dual image capture, optical zoom, image dark enhancement, and 3D shooting. Double shooting has also become a highlight of the major mobile phone brands to emphasize differentiation.

It is predicted that by 2018, the size of the dual-shot industrial chain market is expected to exceed 8.73 billion yuan. The compound growth rate will reach 134% in 16-18. Among them, the industrial chain of CMOS chips, lenses and other modules will usher in rapid development.

In this issue, we recommend a report from Yole, a well-known electronic supply chain market research organization in France, to answer the CMOS market in detail. In the past, the wisdom of things heard the manufacturers crying, and finding a satisfactory CMOS often cost “the power of the wildâ€! I hope that this report will help you guide you.

This report focuses on the key aspects of CMOS market growth, global vendor shipments and price distribution, and distribution and compound growth rates across application markets.

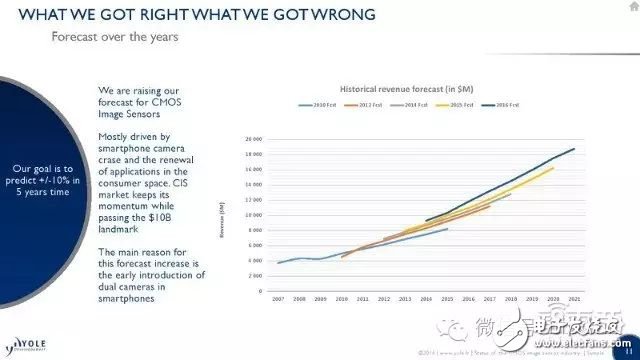

Yole's expectations for the entire CMOS sensor market are on the rise. The CMOS image sensor market has been maintaining this upward momentum since it reached a milestone of $10 billion in revenue. The main driver is the revitalization of the dual-camera space for smart phone camera applications.

According to market revenue forecasts starting in 2007, revenues will reach $19 billion by 2021. In other words, it is expected that by 2021, the market demand for mobile dual-camera technology will reach nearly 20 billion US dollars. The biggest winners will be the mobile phone manufacturers represented by Apple and the semiconductor manufacturers represented by SONY.

When Yole released the first report of this series in 2010, the entire imaging industry was still at a turning point. At that time, the market benefits of CMOS (Complementary Metal Oxide Semiconductor Photosensitive Components) just reached the mainstream CCD (Charge Coupled Device Camera). Half of it.

Since last year, the entire industry has reached a milestone of 10 billion US dollars in revenue, and has become a key technology for major semiconductor companies such as Sony, Samsung, ON Semiconductor and Hynix.

The mobile terminal is still the most important application market for CMOS image sensors, which requires components to meet the volume and performance requirements of the mobile terminal, so overall revenue has also maintained excellent growth. The industry's revenue in 2015 reached 10.3 billion US dollars, and will grow at a compound growth rate of 10.4% to 2021, when the revenue will reach 18.8 billion US dollars.

At this stage, the most dynamic market for CMOS image sensors lies in mobile devices and automobiles. Therefore, the new performances that will be brewed in the future will also serve the above two markets.

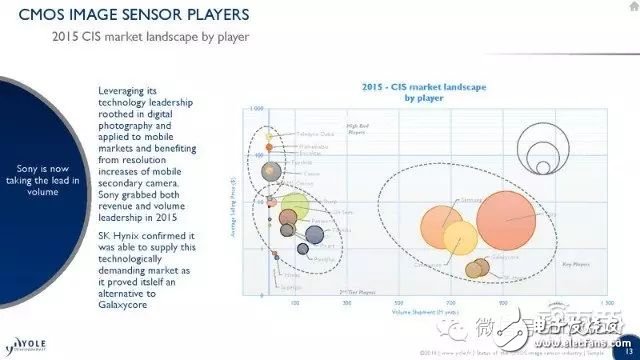

The figure below reflects the market pattern among the various players of the entire CMOS image sensor.

The horizontal axis represents device shipments and the vertical axis represents average sales price. Therefore, the circular area reflects the revenue of various manufacturers in 2015.

The most eye-catching performance is Sony, which relies on the technological advantages in digital imaging and mobile applications, while benefiting from the dual-camera camera resolution requirements, Sony won the market in 2015 and its revenue and revenue. The double champion.

In addition, the main players in this market are Samsung, Howe, Hynix and Gekewei. From the perspective of shipments, the second echelon players include ON Semiconductor, Panasonic, STMicroelectronics, Taiwan Prime Minister, Toshiba, Piper, Sharp, e2v, and Wonderful Optoelectronics. Although the shipment volume is not high, but the unit price is higher, the main high-end brands include Canon, AMS Cmosis, Fairchild Semiconductor, Essexida, Japan Hamamatsu and Canadian brand Teledyne DALSA.

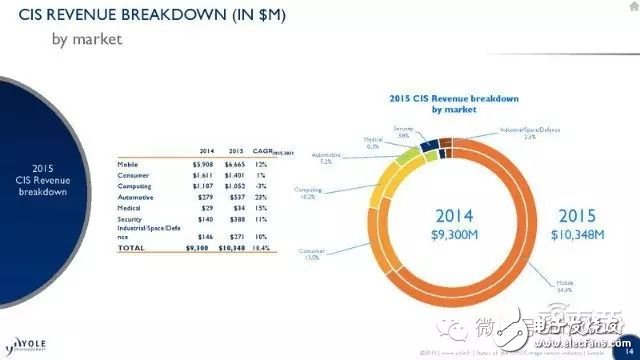

Segments in different fields have different performances year after year.

Overall, the total revenue of the CMOS image sensor market in 2014 was $9.3 billion, which reached 10.3 billion in 2015, a compound growth rate of 10.4%.

As the absolute main body of the market, the mobile terminal has a share of around 60%. In 2015, there was a 12% increase from 2014, accounting for 64.4%.

The consumer market accounted for 13.5%, which is the second largest share of the whole. The share in the two years is almost the same.

The computing market, which accounts for about 10%, showed a slight contraction.

The automotive market accounted for 5.2% in 2015, while showing the highest growth, with a 23% increase in share.

The remaining relevant market segments are security, industry, space technology and defense.

Look at the revenue performance of each brand.

Sony has won the revenue for two consecutive years, and its 2015 revenue reached 3.645 billion US dollars, while maintaining a 31% year-on-year growth.

From the second to the twelfth, Samsung, Howe, Anson, Canon, Toshiba, Panasonic, Hynix, Geco Micro, STMicroelectronics, Taiwan Prime Minister and Pai Er.

Among them, Hynix, Panasonic, ON Semiconductor, and Pai Er have maintained a fairly high growth rate.

While Samsung ranks second with $1.93 billion (2015) in revenue, its growth rate is only 6%, which is not high. The same growth is also weak Taiwanese technology.

However, in the top 12, the market decline is not uncommon. ST's revenue in 2015 was only $200 million, down 23%. The same market is shrinking, including Canon, Gecomi, Howe and Toshiba.

Let's take a closer look at the future of the largest mobile market.

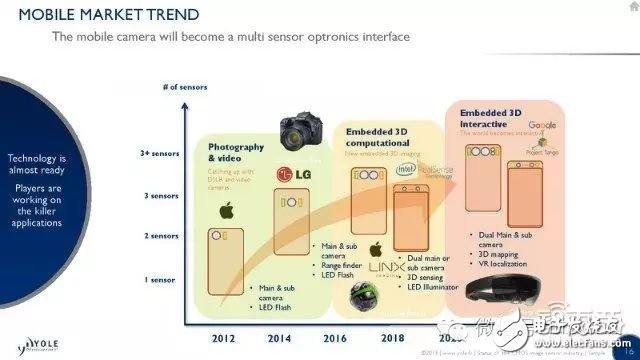

The mobile camera will become a photoelectron complex of multiple sensors in the future.

We are transitioning from the digital age of integrated cameras, LED flashlights, and rangefinders to the era of embedded 3D computing. Dual-shot is just an entry-level product in this new era. Combined with 3D sensors, more giants have been pre-layout in this area, including Intel's RealSense technology, Apple's acquisition of LinX Image Inc., and Germany's 36-camera Panon hand-to-ball panoramic camera.

Even in the future we can already see, embedded 3D technology must fully reflect the interactivity, which requires the addition of 3D graphics and VR positioning sensors. Related projects like Google Project Tango and Microsoft HoloLens are such a prototype.

In fact, the relevant technology is ready, to see who can take the lead in bringing killer products.

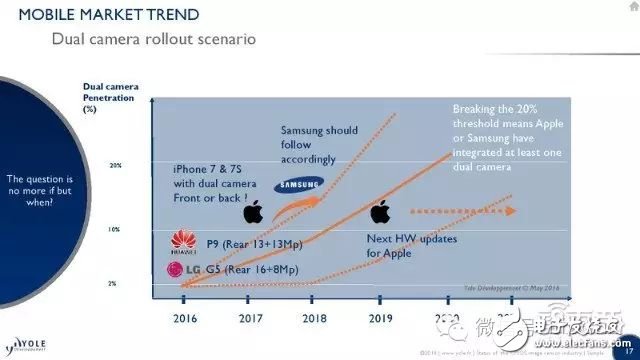

Although Zhizhi was reported in the past, it was learned from Cool CEO Liu Jiangfeng that Coolpad launched the first dual-camera phone in China in 2014.

However, from a global perspective, the organization believes that 2016 is the first year of the double-shot explosion. The representative models at this stage include the LG G5, Huawei P9 and iPhone 7 Plus. With Samsung joining the dual-camera trend, it is expected that the penetration rate of dual-camera smartphones will exceed 20% by 2020.

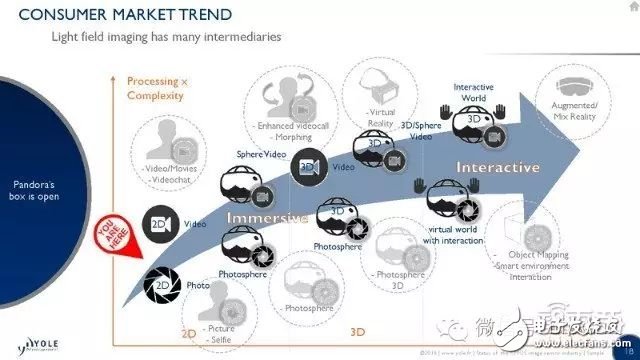

The future consumer electronics market will develop from the current 2D camera and camera to the higher dimension and more complex information processing.

The experience we will be welcoming in the future is not just simple panoramic pictures and videos that have been brewed at the present stage, but also more realistic 3D panoramic image performance. You can imagine video in the VR world and friends. How much will it feel. Not only that, the interactive technology of object light field information projection and intelligent environment will be realized in the world of A.

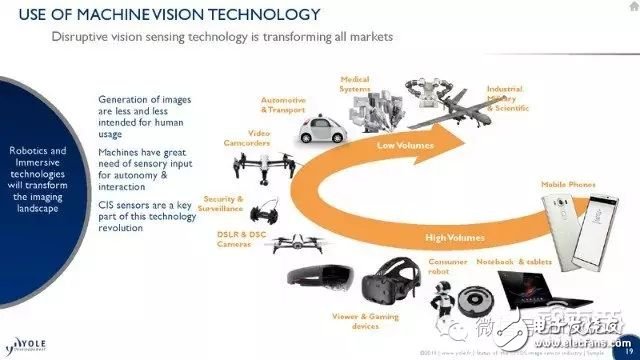

Whether it's a huge number of smartphones, laptops, tablets, consumer robots, digital SLRs, dynamic control systems on drones, security, mobile cameras or automotive radars, or a small number of applications in the industry, Defence, medical imaging equipment, or the need to integrate into robotics, or the need to develop into an immersive experience, out of the need for automation and interactivity, these will change the landscape of the entire image industry, and machine vision technology is The key is that it will bring about a technological revolution throughout the industry.

This report cuts into the smart industry from the perspective of image sensors, reveals market data to us, sorts out market patterns, and predicts market trends.

In the past, we introduced the strengths of all parties in the supply chain, and we often see the performance of Japanese companies quite impressive. What is special about this report today is the relatively growth.

Among them, Sony, which has sprung up, made Toshiba and Matsushita of the same game unprepared. Combined with our observations of the industry, Sony can take the lead in joining the first echelon in the wave of VR rise. It is no accident, but paving the way. Despite the glory of the past, Sony is still rebounding to the high point of the past five years. However, the trend is there, and it is bound to grow strongly.

We seem to see a problem in the chaos of the smart industry, that is, image transformation. This is a technological revolution that cannot be avoided in any field. No matter where you are, no matter what your foothold is, you can actively participate in the transformation of the image.

(PS says that if image transformation is the development of technology so far, the evolution of the machine "open eyes"; then perhaps another topic is artificial intelligence, which is another big evolution of the machine "opening the heart." The technological innovation of input and output new cores seems to be the future technological development trend.)

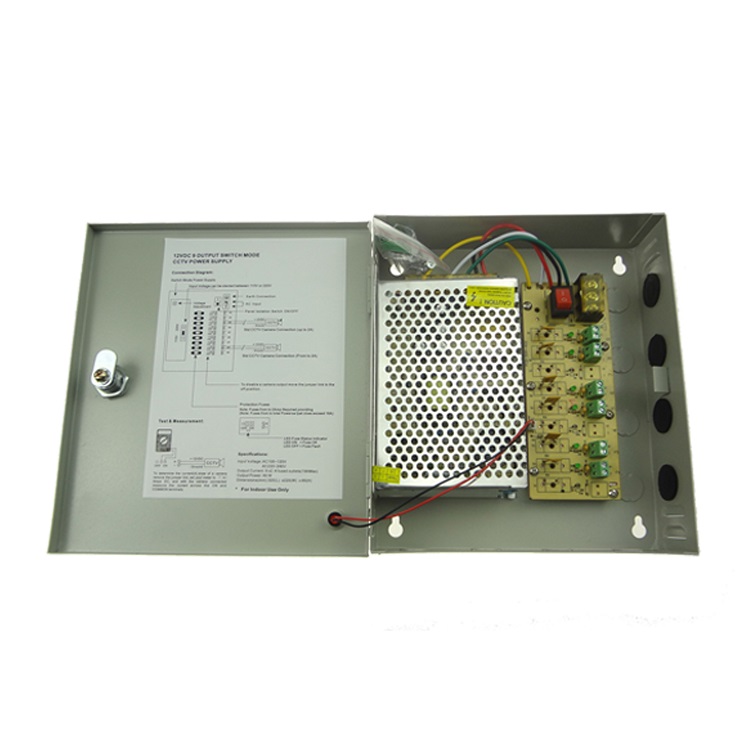

It is a monitoring centralized Power Supply, metal casing and circuit board are made of high temperature resistant flame retardant materials, with independent fuse automatic protection function, when the power supply short circuit and other unexpected situations occur, the power supply can be automatically blown with Fuse.

We have 60W, 120W, 180W, 240W, 360W CCTV Power Supply Box for choose ,which offering multi channels ,such as 4CH/ 6CH/ 9CH/ 18CH, etc. Metal case power supply Box for CCTV Security Camera has a worldwide input, which can be used for access control, building, and CCTV monitoring system all round the world.

Power Supply Box,CCTV Power Supply Box,AC Power Supply Box,DC Power Supply Box

Shenzhen Yidashun Technology Co., Ltd. , https://www.ydsadapter.com